Philippines

- Introduction

The reform of the tobacco and alcohol excise tax system, Republic Act (RA) 10351, in the Philippines in 2012 has been an unqualified success, in terms of both the law’s progressive and innovative features and its immediate, dramatic outcomes. The indications are that the gains will be sustained in the longer term, although Congress will review the law in the third quarter of 2016, with the accession of a new administration.

- Background

The landmark 2012 legislation on tobacco and alcohol taxation, popularly known as “sin taxes”, corrected the fundamental weaknesses of the old law embodied in the National Internal Revenue Code. It took 15 long years to reform the law enacted in 1997 as part of the comprehensive tax reform programme. The old law permitted a change in the excise tax on tobacco from an ad valorem tax to a specific tax, in order to check the abuses committed under the ad valorem system. In that system, the leading tobacco manufacturer resorted to transfer pricing by under- pricing cigarettes at the factory gate before they were sold to dummy wholesale entities. It was a creative way of evading taxes. Pursuing a tax evasion case was difficult, given the strong political connections of the tobacco manufacturer, and a regulatory solution was used.

The shift to a specific tax turned out, however, to be a cosmetic change. The 1997 law, and amendments made in July 2004 (RA 9334), contained several egregious provisions:

- The price classification freeze benefited “legacy” brands that were on the market before enactment of the 1997 law, as their price classification for tax rates was rigidly fixed on the basis of 1996 net retail prices. Thus, their tax rate classification remained the same, although the increase in their prices should have led to a higher price classification and therefore higher tax rates. New brands were taxed on the basis of their actual (current) net retail price and thus at the highest tax rate bracket (see below).

- The complex tax structure consisted of four price classifications for machine-packed cigarettes with correspondingly low tax rates. In 2011, the excise tax rates for machine-packed cigarettes were as follows:

- PHP 2.72 (USD 0.063[1]) for cigarettes with a net retail price (i.e. excluding VAT and the excise tax) < PHP 5.00 (USD 0.12) per pack,

- PHP 7.56 (US$ 0.17) for cigarettes with a net retail price of PHP 5.00 but not exceeding PHP 6.50 (USD 0.15) per pack,

- PHP 12.00 (US$ 0.28) for cigarettes with a net retail price > PHP 6.50 but not exceeding PHP 10.00 (USD 0.23) per pack and

- PHP 28.30 (USD 0.65) for cigarettes with a net retail price > PHP 10.00 per pack.

Note, however, that the original price classification of “legacy” brands was retained, even though their actual prices, without the price classification freeze, would have led to an upward re-bracketing of price classification. In fact, even brands classified as low-priced and medium-price (with tax rates of PHP 2.72 and PHP 7.56, respectively) should have been paying the premium tax rate of PHP 28.30 if they had not been protected by the price classification freeze.

- Real revenue was eroded by non-adjustment of taxes to inflation rates.

RA 10351 in 2012 contained the following essential reforms with respect to tobacco taxation:

- The price classification freeze was removed and steps were taken towards a simple, unitary tax system, which will take effect fully on 1 January 2017.

- The excise tax rates were raised significantly:

- A tax rate of PHP 12.00 (USD 0.28) – from the low of PHP 2.72 – per pack for machine-packed cigarettes with a net retail price of ≤ PHP 11.50 (USD 0.27), effective on 1 January 2013, followed by annual increases in the tax rate of up to PHP 30 (USD 0.71) per pack on 1 January 2017. Despite attempts by some tobacco firms to depress prices artificially, the effect was to increase the price per stick of the most popular brand from PHP 0.80 (USD 0.02) at the end of 2012 to PHP 1.40 (USD 0.03) per stick in June 2014, representing a 75% increase (data from the National Statistics Office); and

- A tax rate of PHP 25.00 (USD 0.59) per pack for machine-packed cigarettes with a net retail price > PHP 11.50, effective 1 January 2013, to be followed by an annual increase of up to PHP 30 per pack on 1 January 2017.

- An automatic adjustment of the tax rate to inflation by increasing the tax rate by 4% every year thereafter (based on the past average inflation rate in the Philippines), effective on 1 January 2018.

RA 10351 has another important feature, which goes beyond correcting the structural weakness of the old law on tobacco and alcohol excise taxation. This is a provision on earmarking the bulk of the incremental revenue from excise taxes on alcohol and tobacco products to health programmes[2].

- Description of the earmarked tax

RA 10351 states that the remainder of the incremental revenue, after deduction of the ear- marked allocations from the tobacco excise taxes to the alternative livelihoods programme for tobacco farmers and other economic projects in tobacco-growing provinces, be dedicated to health expenditures. As the amount earmarked for tobacco farmers and tobacco-growing areas is equivalent to 15%, the annual allocation for health programmes is equivalent to 85% of the incremental revenue collected from tobacco (and 100% from alcohol) excise taxes in the preceding year. Thus, although the intention of the 2012 law is to use all the incremental revenue from the increase in tobacco and alcohol tax rates to finance universal health care, the full amount cannot be allocated[3].

Since the amount for the earmarking (equivalent to 15 percent of the incremental revenue) that benefits the tobacco-growing local government units is already defined by the two laws, it is first deducted from the total. The remainder of the net amount or the bulk of the incremental revenue is then allocated to health programs.

RA 10351 specifies that the areas to be funded by the incremental revenue are universal health care under the National Health Insurance Program, attainment of the health-related Millennium Development Goals, health awareness programmes, medical assistance and health enhancement facilities. The allocation of the incremental revenue is distributed with 80% (68% of total incremental revenue[4]) allotted to finance universal health coverage, the Millennium Development Goals for health and health awareness and the remaining 20% for health expenditure (17% of total incremental revenue[5]) for medical assistance and health enhancement facilities in various political and district subdivisions.

The original goal was to generate financing that would at least finance health insurance for the poorest 40% of Philippine households, but the revenue projection was conservative, as the model assumed a higher price elasticity coefficient. The actual additional revenue is greater than the estimate and will carry through in succeeding years. Although the net or incremental revenue per year varies (probably with an annual reduction), the amount is cumulative over time, and the Government can expect additional revenue for health programmes, although less each year. For example, the incremental revenue was PHP 51.17 billion (USD 1.21 billion) in 2013, the first year of implementation of the “sin tax”, and PHP 50.23 billion (USD 1.13 billion) the following year. The amount earmarked for health programmes did not decrease by PHP 1 billion; rather an additional PHP 50.23 billion was allocated for universal health care and related programs in 2014. Thus, health programmes funded through the sin tax are protected, unless the Government or the Department of Health shifts priorities.

Earmarking sin taxes for health is not unique, as the old law (RA 9334, passed in 2004) had a similar provision, whereby 2.5%of the incremental revenue from the tobacco and alcohol excise taxes was allocated to the Philippine Health Insurance Corporation to meet the goal of universal coverage and another 2.5%of the incremental revenue to the Department of Health as a trust fund for disease prevention. However, unlike the new law, which has no time limit (unless it is amended), sin taxes were earmarked for health for only 5 years, from January 2005. The amount earmarked was only 5%, which pales to insignificance as compared with the equivalent of 85% in the new law. Furthermore, the earmarking of taxes for health in the old law did not actually translate into new spending for health during the 5 years that it was in effect, as the incremental revenue could not be used for new spending or new programmes of the Department of Health. In practice, the incremental revenue was mixed with general revenue and became a subset of the health budget that would have been provided via the General Appropriations Act. In the new law, attribution to new programmes and new spending is clear. The Implementing Rules and Regulations for RA 10351 require the Department of Health to “identify the annual funding requirements for financial risk protection, medical assistance, health enhancement facilities program and other health programs.”

The Department of Finance determines the actual incremental revenue and submits the projected incremental revenue for the year immediately preceding the budget year to the Department of Budget and Management. If the actual incremental revenue exceeds that projected, the surplus is carried over to the following budget year. The Bureau of Internal Revenue and the Bureau of Customs, both under the Department of Finance, collect the excise taxes and certify the incremental revenue collected. The Department then endorses the certification to the Department of Budget and Management.

The Department of Health submits a medium-term expenditure program for universal health coverage to the Department of Budget and Management and, every November, also submits “a list of projects and programs to be implemented for universal health coverage, including funding requirements and guidelines for prioritization”, as input for the preparation of forward estimates. In addition, the Department of Health and its agencies, including the Philippine Health Insurance Corporation, submit reports and financial statements, including a special budget, for the release of the earmarked funds. In turn, the Development Budget Coordination Committee, which includes the Department of Budget and Management and the Department of Finance review the Department of Health’s medium-term expenditure programme, which is the basis for yearly allocation. Each concerned agency submits a detailed report on expenditure and use of the earmarked incremental revenue to the Oversight Committee, and the reports are published on the Official Gazette and on the websites of the agencies.

Earmarking the incremental revenue from tobacco (and alcohol) excise taxes is thus unique:

- The largest proportion, about 85%, goes to health programmes, especially universal health coverage.

- Earmarking is continuous.

- The implementing rules and regulations for earmarking are well defined in terms of attribution, transparency and accountability.

Earmarking the bulk of the incremental revenue for health spending was an essential part of making health the principal objective of the tobacco and alcohol excise tax reforms. The twin goals for health are to reduce smoking (particularly prevalence) and excessive alcohol drinking and to use the revenue for health programmes. Use of the sin tax as a health measure, with generation of substantial revenue, explains the success of the reforms. Nevertheless, we should answer the question often raised by economists that earmarking, no matter how good the intention, is prone to rigidity and inefficiency.

The revenue from an earmarked tax is used exclusively for a specific purpose or a programme. Tax revenue is part of general appropriations, which are then allocated to various government programmes, while earmarking is imposed for economic, social or political reasons. Such taxes constitute only a small percentage of total taxes. The main criticism of earmarking is that it constrains the choice of allocation or spending, whereas the funds could have been used for more deserving programmes or projects, or that the earmarking is overfunded, resulting in huge opportunity costs.

Sin tax earmarking for health is, however, sound, notwithstanding these theoretical issues. Funding of the country’s universal health coverage does not depend on tobacco and alcohol excise taxes: the incremental revenue fills the gap left after general appropriations and health insurance premiums. For example, before the sin tax reform, the Philippine Government was unable to subsidize health insurance for the second quintile of poor families and assigned al- location of resources for health insurance for this quintile to local government units. These units complained, however, that they could not both provide health services and raise additional funds for health insurance. With the sin tax reform, health insurance has become universal, and the Government sponsors the poorest 40% of families. The entire general population benefits from earmarking for health. Health spending is a public good and the support of the people and their representatives in Congress for health spending makes earmarking acceptable.

Earmarking was also a political act or even a political imperative. It would have been much more difficult to pass the sin tax law without broad support generated by the appeal of earmarking for health, in light of the intense and powerful lobby of vested interests. Ultimately, the earmarked tax not only significantly increased the budget for health but also contributed to the general level of taxation, thus expanding the overall fiscal space. Passage of the bill in 2012 led to a series of credit upgrades, and the country attained two notches above investment grade for the first time.

- Impact of the tax

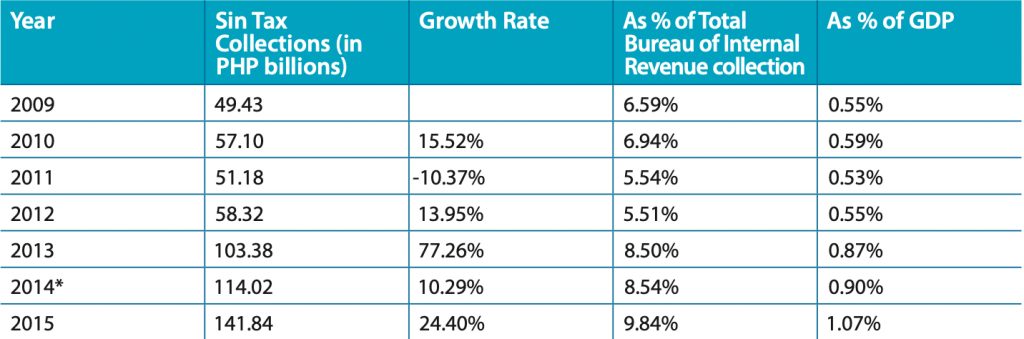

The Philippine sin tax reform is now hailed as a global good, or best, practice. For its achievement in passing a bold law in 2012, the Philippine Government received the 2015 Award for Global Tobacco Control from Bloomberg Philanthropies. In the first year of implementation of the law, the revenue from the sin tax increased from PHP 56.32 billion (USD 1.38 billion) at the end of 2012 (enhanced by front-loading of volume removal to avoid the steep increase in tax rates that took effect in January 2013) to PHP 103.38 billion (USD 2.43 billion at the end of 2013), an increase of 77%. Total revenue from the sin tax continued to increase in 2014, by 10.3% in 2014 and further increased by 24.4% in 2015 (Table 1).

Table 1: Sin Tax Collection as % of total Bureau of Internal Revenue collection and as % of GDP

* includes the Bureau of Customs collections amounting to PHP 44.85 million

* includes the Bureau of Customs collections amounting to PHP 44.85 million

Furthermore, since implementation of the law, the actual increase in incremental revenue has surpassed that projected. In 2013, the actual incremental revenue from tobacco excise taxation was PHP 41.84 billion (USD 0.99 billion), whereas that projected was PHP 23.40 billion (USD 0.55 billion); in 2014, these figures were PHP 39.39 billion (USD 0.89 billion) and PHP 29.56 billion (USD 0.67 billion), respectively. The actual annual incremental revenue from alcohol excise taxes was slightly below the target in 2013 and 2014. Overall, the total incremental revenue from tobacco and alcohol excise taxation was PHP 51.17 billion (USD 1.21 billion), PHP 50.23 billion (USD 1.13 billion) and PHP 73.09 billion (USD 1.61 billion) in 2013, 2014 and 2015, respectively (Table 2).

Table 2: Tobacco and alcohol sin tax revenue, exceeding target and increasing year-on-year

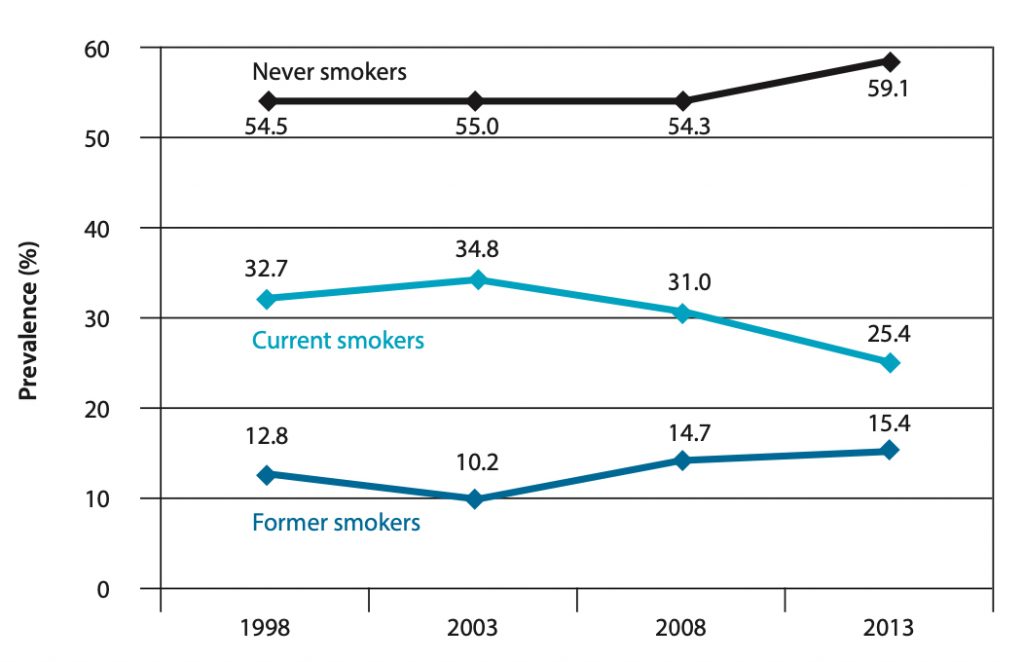

The steep increase in tobacco taxation during the first year of implementation has had a considerable impact. A drop has been seen in volume removal (a proxy for consumption) of cigarette packs of 15.55% was seen in 2013 (from 5.76 billion packs in 2012 to 4.87 billion packs in 2013) and 19.55% in 2014 (from 4.87 billion packs in 2013 to 3.92 billion packs in 2014). The strongest evidence for a health impact is the significant reduction in smoking prevalence, from 31% in 2008 to 25.4% in 2013 (the first year of implementation of the sin tax). The main explanation, as suggested by Fig. 1, is the deterring effect of the steep tax rate increase on would-be smokers, particularly among the young and the poor.

Figure 1: Reduction in smoking prevalence

Source: National Nutrition and Health Survey (NNHeS); and Antonio Dans M.D.

Source: National Nutrition and Health Survey (NNHeS); and Antonio Dans M.D.

Note: Prevalence of Never, Current, and Former Smokers, Philippines, NNHeS, 1998 to 2013

The health impact should also be measured in terms of the budgetary increase for specific programmes, as the sin tax law defines the health programmes to be funded. For example, between 2013 and 2014, funding for financial risk protection increased by 180% (from 12.63 in 2013 to PHP 35.34 billion in 2014).

Since the start of implementation of the law in 2013, the budget of the Department of Health increased from PHP 53.23 billion (USD 1.25 billion) to PHP 83.72 billion (USD 1.89 billion) in 2014 (a year-on-year increase of 57.3%) and PHP 86.97 billion (USD 1.91 billion) in 2015 (3.9% increase). The approved budget in 2016 is PHP 122.63 billion (USD 2.7 billion) (41.0% increase).

The greatest impact of incremental revenue from the sin tax on health spending is health insurance coverage of the poorest 40% of families. Between 2012 and 2014 the sponsored programme increased Philippine Health Insurance Corporation coverage of the poor from 4.61 million members to 14.71 million members, or an increase of 219% during the 2-year period, and total membership increased from 80.92 million to 86.22 million between 2012 and 2014. The sin tax incremental revenue is also the source of funding for mandatory coverage of all Filipino citizens living in the Philippines aged ≥ 60 years who are not indigent or are not sponsored members or have no qualifying contributions to be entitled to Health Insurance benefits. These “senior citizens” are entitled to many benefits, including primary care and the no-balance billing policy (only in accredited Government health care facilities).

- Challenges and conclusions

The sudden increase in the budget for universal health coverage posed new, complex challenges. The Department of Health has perennially faced the problem of absorptive capacity, and the influx of new money has exacerbated the problem of under-spending. The Department has fragmented programmes, putting into question efficient use of the additional resources. Further, the shortage of health care providers and the inadequacy of health facilities jeopardize provision of services for which funds have been augmented by the dramatic increase in the budget. This problem can be addressed mainly by allocating a larger budget from the sin tax revenue to human resources.

The sin tax revenue has made it possible for the Philippine Health Insurance Corporation to finance membership of 40% of the poorest Philippine households and to extend some benefits. It is critical that the members, and especially the poor, use the benefits. There has been an increase in benefit use by different segments of the population, although the rich still access services more than the poor. The Insurance Corporation is putting in place safeguard systems, including accreditation of health providers and electronic recording, to check abuses in the use of benefits.

A sensitive issue with respect to universal health coverage is setting programme priorities, in view of trade-offs, cost-effectiveness and equity. The Philippines has a vibrant civil society, which accounts not only for the success of the sin tax reform but enables stakeholders to engage Government officials in policy debate or dialogue.

The Philippine tobacco and alcohol excise tax reform of 2012 offers rich lessons. The design of the law to restructure the system and make health the primary objective was a crucial factor in its successful outcomes. The twin goals of better health outcomes and generating revenue have been met. Furthermore, the tax reform is the main explanation for the increase in tax effort, resulting in a series of credit upgrades and thereby boosting investor confidence. The generation of revenues is robust, with yearly tax rate increases until 2017, when the unitary tax takes effects; thereafter, the tax rate will increase automatically by 4% annually to correct for inflation.

Health has also benefitted. Smoking consumption and prevalence have been significantly reduced, and the bulk of the incremental revenue is allocated to health programs, especially for universal health coverage. The increase in the health budget is dramatic, and health expenditure has grown consistently every year since passage of the law. Despite the reservations of economic theory, earmarking is acceptable on the grounds of both efficiency and the political imperative. Allocation of the revenue for health benefits the entire population. The programmes and projects that benefit from the incremental revenue are identified, and attribution of funds is ascertained. The rules for allocation of the revenue ensure transparency and accountability. The revenue earmarked for universal health coverage is robust and sustainable, unless the law is amended. The incremental revenue is computed on the basis of the 2012 baseline, and the tax will be automatically indexed to inflation by 2017. In view of the price inelasticity of tobacco and alcohol products, additional revenue can be expected every year.

Once the law consolidates in 2017, a new round of tax rate increases will be necessary to address issues of affordability and extension of health expenditure. With the momentum and lessons of the 2012 reform, the Government and civil society are well positioned to achieve the objectives. The Philippine experience and insights into the sin tax reform deserve further scrutiny and recognition.

References

[1] Exchange rates used are annual averages from the central bank of the Philippines.

[2] Incremental revenue, as defined in the Implementing Rules and Regulations of R. 10351, “shall be computed as the difference between the total actual excise collections from alcohol and tobacco products for the year under consideration with Reform Implementation under R.A. 10351, and the Baseline Excise Collections (Without R.A. 10351) for the same year.” The Implementing Rules and Regulations define baseline excise collections (without RA 10351) “as the pertinent excise collections under the 2012 structure,” as provided by the old law (RA 9334).

[3] Earmarking of a portion of tobacco excise taxes for tobacco farmers and tobacco-growing provinces is stipulated in two laws: RA 7171 and RA 8240 (and reaffirmed in RA 9334). RA 7171 (An Act to Promote the Development of the Farmer in the Virginia Tobacco-producing Provinces) states: “The financial support given by the National Govern- ment for the beneficiary provinces shall be constituted and collected from the proceeds of fifteen percent (15%) of the excise taxes on locally manufactured Virginia type of cigarettes.” RA 8240 states: “Fifteen percent (15%) of the incremental revenue collected from the excise tax on tobacco products under this Act shall be allocated and divided among the provinces producing burley and native tobacco in accordance with the volume of tobacco leaf production”.

[4] That is, four-fifth of the 85 percent of the total incremental revenue from the tobacco and alcohol taxes, or .8 x .85 = .68

[5] That is, one-fifth of the 85 percent of the total incremental revenue from the tobacco and alcohol taxes, or .2 x .85 = .17

Related report

World Health Organization. (2016). Earmarked tobacco taxes: lessons learnt from nine countries. Geneva, World Health Organization.